VIA Daily Mail by Josh Gardner

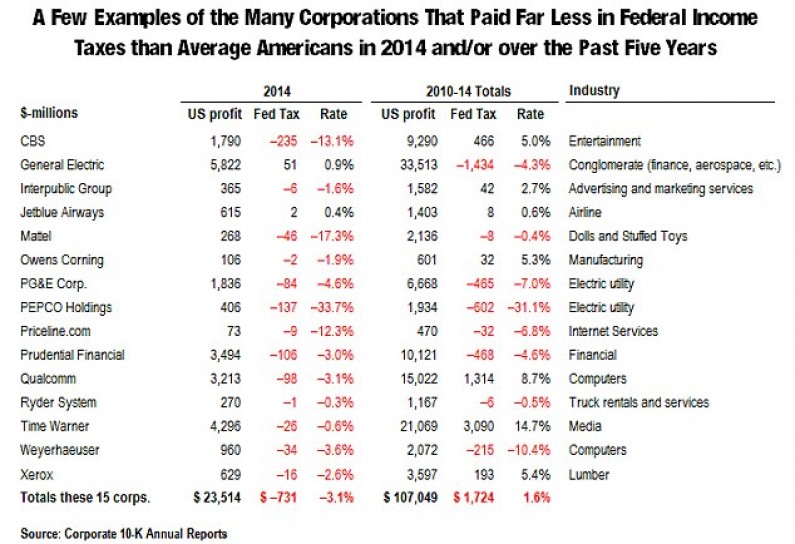

- Many of the companies named in a report out April 9 from the Citizens for Tax Justice even received federal tax REBATES

- The companies include household names such as CBS, Mattel, Prudential and Time Warner

At least 15 Fortune 500 companies, many of them worth north of a $1 billion, paid zero income taxes in 2014, says a report out last week from the Citizens for Tax Justice.

According to the report, household names like CBS, General Electric and Mattel all successfully manipulated the U.S. tax code to avoid paying taxes on their massive profits.

Avoidance: Fifteen Fortune 500 companies managed to get through 2014 without owing a penny in income taxes. What’s more, most of those 15 were actually given federal tax rebates in the tens or even hundreds of millions

To put this harsh reality into perspective, imagine you’re a taxpayer logged on to a tax site in your struggle to determine what you owe Uncle Sam.

You pay upwards of $100 every month for the internet you’re using and could well owe thousands in income tax.

But if your monthly internet payment goes to Time Warner, guess what they’ll be paying this year.

That’s right: zero dollars.

In a way, you may have paid them. Again. The frequently maligned cable company made over $4 billion in U.S. profit last year and subsequently received tax rebates totaling $26 million.

And, as Fast Company notes, it’s all perfectly legal.

One method used by these companies is called accelerated depreciation, which means the tax value of an asset may be claimed in the first years of the purchase rather than over time.

Another method of tax avoidance is active financing. Put simply, this means a company classifies a taxable activity as foreign financing, putting it out of reach of the IRS.

With corporate giants like Pepco, Prudential and Xerox all successfully avoiding paying income tax, Citizens for Tax Justice says American taxpayers and the U.S. government need to wake up and amend the tax code.

The report’s authors write:

‘As Congress focuses on strategies for revamping the U.S. corporate income tax, a sensible starting point should be to critically assess the costs of each of these tax breaks and to take steps to ensure that profitable corporations pay their fair share of U.S. taxes.

Fair? Citizens for Tax Justice wants changes to the corporate tax code and released a report last week that lists the Fortune 500 corporations that managed to squeak by in 2014 without paying a dime in income tax

Follow us: @MailOnline on Twitter | DailyMail on Facebook