On the state of domestic markets:

The last week was a euphemism for the last month(6 months really) in equity investing, which has been filled with worry and questions. With the theme of overpriced equities holding true, many investors fear that the 7% pullback over the last month is the beginning of the end… that is, the end of an insolent bull market that has fought through much doubt and adversity.

The increased volatility is no different that what we’ve seen on the way down as we’ve saw on the climb to 16,000… it’s to be expected. Days like February 3rd, where the Dow lost over 300 pts are just as peculiar as the triple digit gains we saw in December amidst no spectacular economic data and the announcement of Fed tapering. This recent ‘pullback’ isn’t cause for serious concern and is mostly sprung on by anxious retail investors. The cause seems to be a combination of recent issues with emerging markets, bad manufacturing data, and continued trimming of the Fed’s asset purchases. A combination of all three amounting to a wall of worry. Remember, 15,400(DJIA) is still a really good number.

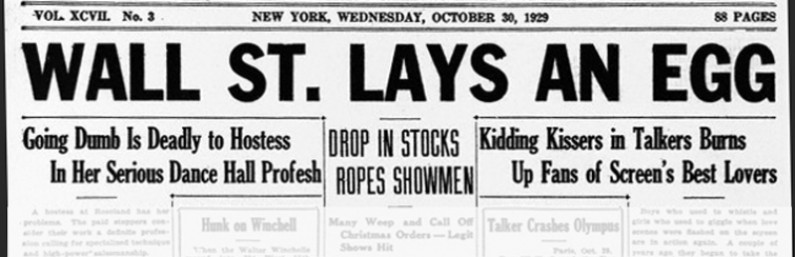

None of the data out of the US has been fantastic over the past year but it has been masked with easy money programs so nobody cared much. Now that those purchases are slowly winding down, any blip can seemingly cause a downward spiral. IE: emerging markets blink, bad manufacturing data comes out and the Fed is slowing purchases down by 20B and there is blood in the streets. The combination of factors is what can induce enough fear for a perfect storm. However, in this case, this isn’t going to be the major turnaround everyone is expecting…. yet. But, it’s a good example of how quickly things can get out of control. Before you know it you there are snapshots of the ‘professionals’ at the NYSE with their eyes wide looking around helplessly while the most notable economic publications report simply sit back and report the disaster as it happens.

Truthfully, this type of pullback was due after the DJIA broke 16,000 amongst luke-ward GDP, unemployment and corporate earnings. US equities are still overpriced but this is not the end and we believe with a reasonable time to recover, the Dow will trade within mid-to-high 15,000’s. That doesn’t mean that won’t come without some anxiety and worry.

BOTTOM LINE

The the key number to watch right now is the support level at 14,600-14,800 that the Dow has been able to hold for about a year now. Trading above that support, we’re okay… anything break in that number could be sign of big trouble. We believe we’re several months out until that happens. Happy trading.

One Response to "Is a stock market crash looming? Not just yet…"